Critical legal issues for cryptocurrency and NFTs

Five major legal issues for owners/creators of cryptocurrency and NFTs in the UK

Introduction

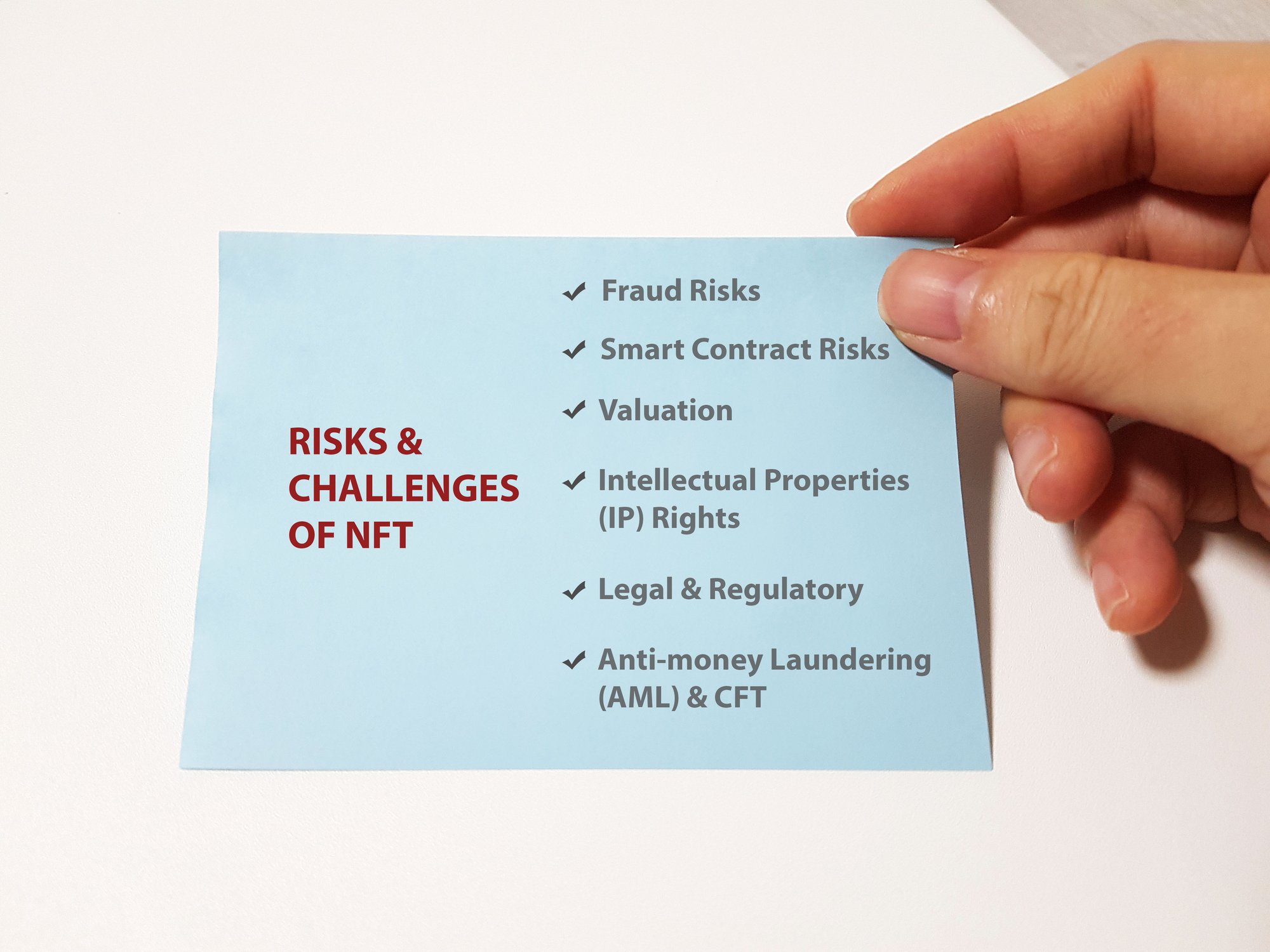

NFTs have existed since 2012, but they are still shrouded in mystery, seemingly inaccessible to most people. Why have NFTs not hit critical mass?

· The blockchain technology that supports NFTs is not widely known. While many have heard of blockchain technology, few understand what it does.

· The law relating to blockchain, cryptocurrency/NFTs is consumed with grey, greyer and greyest areas in intellectual property, financial services regulatory compliance, tax law, to name but a few. For example, a grey area might be the regulated activity status of a hybrid token; a greyer area the regulated activity of an In-Game Token; and the greyest area the regulated activity of an In-Game Token with a gambling element.

· Some view the concept of cryptocurrency and NFTs as mere money-making schemes that do not add any value to the current paradigm. In other words, the current concepts of currency (fiat), art, music, or drama did not need to evolve into these technical decentralised peer-to-peer ideas of cryptocurrency and NFTs. There are many examples of new games that incorporate NFT elements being rejected by their fan base.

Notwithstanding the above, as of 2017, NFTs continue to gain in popularity. Dapper Labs was the first to start selling NFTs linked to digital cat cartons known as CryptoKitties.

In March 2021, Twitter founder Jack Dorsey, widely reportedly, sold his first tweet in 2006 as an NFT for over $2.9 million.

Naturally, such successful monetisation would inevitably fuel the speculation and ingenuity of entrepreneurs to take advantage of the economic opportunities in NFTs. The decentralised peer-to-peer aspects would also create altruistic benefits allowing more people to participate at various income levels.

Since these NFTs can represent tweets and cartoons, entrepreneurs are now using them to fictionalise houses digitise personal documents such as birth certificates and other assets.

What is an NFT?

An NFT (Non-Fungible Token) are a piece of unique digital code; this code is used to establish ownership of assets like images, art, music, video clips, property and other underlying assets.

NFT can be coded on different smart chains like Ethereum Blockchain or Binance.

Non-Fungible means that it's unique and cannot be replaced with another object. For instance, your car is non-fungible. There may be other cars of the same make and model as your car, but there is only one car that is yours. The same reasoning applies to an airline ticket. Each airline ticket has unique data representing a specific seat on a plane. You cannot swap that airline ticket with exactly the same ticket.

However, petrol is fungible. There is no unique gallon of petrol, and it can be exchanged for equal value in currency or other non-cash payment.

How NFTs works

NFTs work by converting assets into a token, which will serve as a digital unit in the blockchain. Since NFTs are a piece of digital code, the token that NFTs formed in blockchain can represent different things and comply with computer code and terms written in the smart contract.

Popular standards that govern both fungible and non-fungible tokens are the ERC-20 standard (fungible tokens); and the ERC-721 standard (non-fungible tokens) on Ethereum.

Recently, Ethereum has released ERC-1155, allowing a single contract to contain fungible and non-fungible tokens.

Binance has its NFT standards BEP-721 and BEP-1155 and its own BEP-2, equivalent to Ethereum's ERC 20.

Is it legal to trade NFT in the UK?

There has been a need to balance the fostering of innovation while protecting consumers from fraud in the UK.

Determining whether NFT activity is regulated starts at how the token is likely to be classed by authorities.

According to the UK Financial Conduct Authority (FCA), tokens are divided into the following broad categories:- e-money tokens, security tokens, hybrid tokens (may or may not be regulated) and utility tokens (unregulated tokens).

E-money tokens: rely on the UK Electronic Money Regulations 2011. Refers to digital payment instructions used to store monetary value.

Security tokens: are governed by the UK Financial Services and Markets Act 2000. This token is regarded as a regulated activity because it monitors and secures the UKs shares, debt, investments.

Hybrid tokens: used to buy certain utilities. A proportion of the token represents some economic yield.

Utility tokens: used solely to buy services and yield no income or capital gain.

Any security token activity is regulated, and the entity running and managing it, including the management involved, need authorisation from the FCA (Financial Conduct Authority).

The FCA has stated that it will consider each activity on a case-by-case basis.

Financial services 101 issues you should be aware of are: Anti-Money Laundering (AML) and Know Your Client (KYC) regulations. Crypto-asset exchange providers and custodian wallet providers, in particular, should take note.

Under the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017, which was amended by that same Money Laundering and Terrorist Financing Regulations 2019, if you are dealing in crypto-asset such as NFTs, you need to consider FCA registration before engaging in any crypto asset activities.

#1. Intellectual Property Rights

Intellectual property is intangible creative work. NFTs are the digital coded version of any type of asset, including logos, blogs, art, literary works, inventions, and symbols. The tokenised creative work is itself a creative work with its own intellectual property (including copyright).

Therefore, protecting intellectual property in your creative work is a critical legal issue for the NFT owner.

#2. Data protection regulation (AKA GDPR)

The EU General Data Protection and Regulation (EUGDPR) and UK General Data Protection and Regulation (EUGDPR) require consideration if you launch an NFT project.

GDPR is quite broad, and the full GDPR text contains about 99 articles that give individuals whose data you collect certain rights on limiting how you use their data.

In the UK, UKGDPR is governed by the Data Protection Act (2018), which supersedes the 1998 Data Protection Act and implements EUGDPR into the UK legal system.

The primary goal of GDPR is to empower consumers to protect their personal data from wrongful third-party processing.

#3. Anti-money laundering (AML) and know your customer (KYC)

In the UK, Anti-Money Laundering (AML) is compulsory for financial services. If you are receiving money publicly for your token, you need to adhere to regulations on money laundering.

The primary Anti-Money Laundering law in the UK is the Proceeds of Crime Act (POCA).

The POCA paved the way for the Money Laundering, Terrorist Financing, and Transfer of Funds Regulations 2017.

The Money Laundering and Terrorist Financing Regulations 2019 implemented the EU Fifth Money Laundering Directive in the UK and came into effect on 10 January 2020. This legislation extends the scope of regulated industries and changes how customer due diligence and enhanced due diligence are conducted.

NFT creators or cryptocurrency owners must have an AML program to address money laundering and terrorist financing. Further, the AML procedure includes a Know Your Customer (KYC) policy, Customer Due Diligence (CDD) procedures, and monitoring.

Financial institutions, banks, NFT creators, and cryptocurrency owners must implement "know your customer and customer due diligence" procedures when a new customer wants to create an account.

The initial process of the new investor/client/customer involves verifying the new customer's identity.

A larger organisation may want to hire an Anti-Money Laundering Officer (AML)) that supervises money laundering activities within the business.

#4. Taxation

There are no tax rules in the UK today that apply specifically NFTs and cryptocurrencies, but this does not alter other existing tax principles that govern other monetary and non-monetary activities in the UK. Therefore if you make a capital gain on the sale of your cryptocurrency or NFT, you will pay capital gains tax, and if you make income on your cryptocurrency or NFT, you will pay income tax on that income. For more detailed tax advice, you should seek the assistance of an accountant.

#5. Royalties

Generally, royalty means compensation paid in return for a license to use intellectual property such as NFTs, art, and music.

Typical royalties work as a percentage of every sale. For example, an artist releases artwork for the advertising campaign for a product and collects 25% of every successful sale of the product.

Blockchain technology-related contracts

NFT contracts and terms and conditions

Conclusion

The legal concerns and regulatory grey areas in NFT and cryptocurrency compliance and contracts are daunting. However, we can assist you to clear all the hurdles to take advantage of this exciting and altruistic technology.

We can work with you to: (1) first advise as to where your activity falls and how to draft your white paper; (2) establish the necessary steps to get authorised and be compliant with the FCA regulations; (3) draft NFT contracts and digital asset eWallet payment and electronic payment corporations’ compliant terms, as well as prepare your general terms and conditions.

To obtain accurate advice about your business' legal compliance status and how we can help, please contact us on (020) 7305-7491 or at peter@pailsolicitors.co.uk, and we would be delighted to assist you.

The writer is an Internet and digital technologies + cryptocurrency law specialist, owner and principal solicitor at PAIL® Solicitors. Peter Adediran's specialist niche areas of practice are digital media business SMEs and IP, contentious and non-contentious. (Charge rates may vary)